Working together to reduce uninsured driving

Every four minutes, a vehicle is seized for being uninsured. Operation Drive Insured unites MIB, UK police forces and other industry stakeholders in tackling this issue through targeted enforcement and public education.

This week-long Tier 1 NPCC (National Police Chiefs’ Council) campaign sees police forces across the UK increase operational activity to identify and remove uninsured vehicles from the road, making roads safer for everyone.

Alongside enforcement activity, MIB leads a public awareness campaign across press and social channels to highlight common insurance mistakes and their consequences, encouraging positive, informed driver behaviour.

Making our roads safer

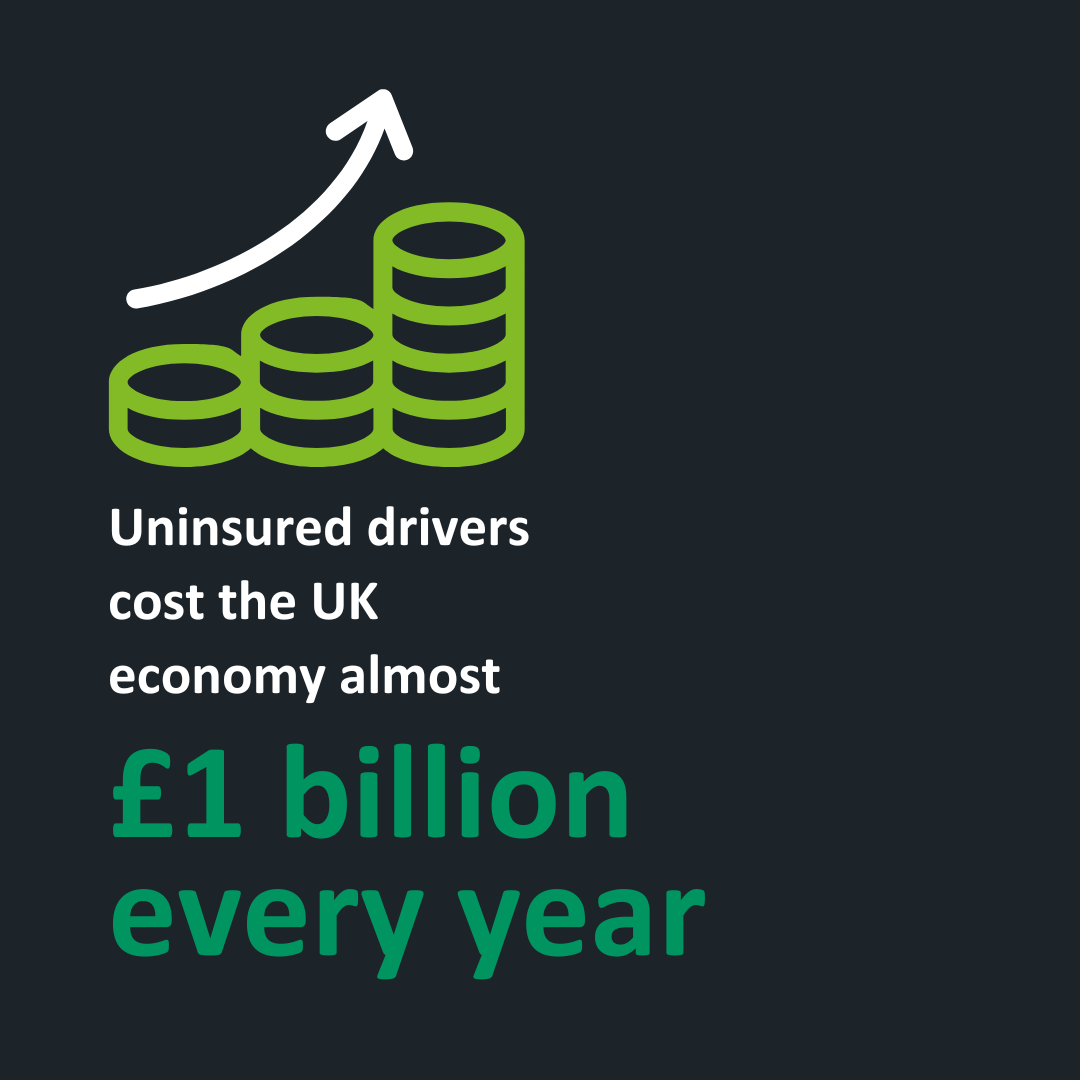

Historical data shows that uninsured drivers are disproportionately involved in road collisions and often connected to secondary offences, including hit-and-run incidents, drink or drug driving, speeding, money laundering and wider criminal networks.

Reducing uninsured driving is therefore a key part of improving road safety and community protection.

To support police forces during Operation Drive Insured week and throughout the year, MIB provides:

- Law enforcement liaison officers to join roadside operations, from multi-agency operations to mobile patrols. This ensures a direct link to Navigate - the home of live motor insurance policy data - and the MIB Police Helpline.

- Predicted movements of known uninsured vehicles, identified by Operation Tutelage. This provides a narrow time window in which the vehicle is expected to be in a known location.

- #DriveInsured stickers to be placed on seized cars, raising awareness across other motorists that insurance status can be checked at the roadside.

- Social assets to enable forces to highlight the dangers, consequences and pitfalls of uninsured driving.

Sign up for your 2025 Operation Drive Insured pack

Access ready-to-use graphics, key messages and social media assets designed to support your local communications. These materials have already helped forces nationwide engage thousands of drivers and raise awareness of uninsured driving.

Many drivers unintentionally drive without the correct cover, unaware of the significant financial and legal consequences.

Even the most careful drivers can get caught out. A quick check of your policy today could save a lot of stress (and expense) later.

Here are a few easy mistakes worth double-checking:

- Forgotten when your insurance expires? Check your renewal date today.

- Assumed your policy auto-renews? Not all do, and expired payment cards can cause lapses.

- Kept a vehicle off the road without declaring it SORN with the DVLA? Make sure it’s officially off-road.

- Thought fully comprehensive cover lets you drive someone else’s car? It often doesn’t - check your policy first.

- Using your car for work or deliveries on a social-only policy? You’ll likely need commuting, business or hire-and-reward cover.

- Found a deal on social media? Double-check it’s from a genuine insurer, ’Ghost Broking’ scams are common.

- Added yourself as a named rather than main driver on a car you mainly drive? That’s ‘fronting’, and it’s illegal.

- Taking a private e-scooter on public roads? Only local authority-operated scooters are legal.

A quick review now can help you stay fully protected and avoid some costly surprises later.

The consequences of uninsured driving are serious and long-lasting

- £300 fixed penalty fine

- Six penalty points on your licence

- Vehicle seized and potentially crushed

- An unlimited fine and a possible driving ban if the case goes to court

- Impacted job prospects, because driving convictions can show up in background checks

- £1,000 increase in average premiums for future motor insurance policies

Even experienced and conscientious drivers can be caught out by small errors.

Educating motorists to regularly check they have valid and adequate insurance in place helps prevent avoidable offences and supports safer roads for everyone.

An uninsured vehicle is seized every four minutes in the UK

Who is MIB?

Click below to find out more about how we tackle uninsured driving, help victims, and utilise data to support police and insurers.

Claim against an uninsured driver

If you've been the victim of an uninsured driver, you can now register and submit your claim online.

Need some help?

Answers to some common questions about uninsured driving, including what to do if you receive an Insurance Advisory Letter.